Instead of catching some Zs, he lost some $. An unnamed German employee of an unnamed German bank made worldwide headlines when he accidentally transferred 222,222,222.22 Euros ($293 Million) instead of 62.40. What was his reason? He claims that he ?fell asleep for an instant? while typing the number 2, resulting in the colossal blunder. But it was his supervisor who was reprimanded and sacked. However, the error was quickly corrected, the supervisor eventually got her job back, and hopefully the employee got some rest.

This is Sharon Jones, who "found" the ticket.

Here’s a strange story for our Financial Blunder list, and one that has a happy ending. Sharon Duncan purchased a Diamond Dazzler lottery ticket at the Super 1 Stop in the tiny town of Beeb, Arkansas in July 2011. When she scanned it, it did not come up as a winner, and she tossed it in the bin below. Along came Sharon Jones, who combed through the trash, found the discarded ticket, and discovered that it was indeed a $1 million dollar winner. Elated, Jones spent a lot of the money on herself and her children, only to be brought to court by the convenience store manager, who claimed Jones took the ticket from the bin that had a sign saying ?Do Not Take.? When Duncan got wind of it, she joined the suit, claiming that she was misled by the scanner reading and deserved the winnings. A judge and jury debated the matter and returned the decision in Duncan’s favor, meaning that Jones would have to return the money she spent. Jones appealed, but before the case could go back to the courts the parties settled out of court for an undisclosed sum.

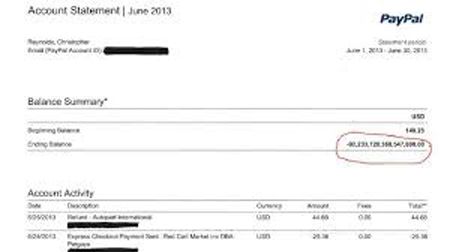

"We regret to inform you of our grievous error."

Pennsylvania resident Chris Reynolds opened his monthly PayPal statement in his email to find a balance of $92,233,720,368,547,800. He was stunned, and posted a photo of the document for his friends to see on Facebook. But before he could go on a spending spree, PayPal recognized their ?error? and took back the gargantuan sum. As a kind gesture, the company made a ?modest? donation to an undisclosed charity of Reynolds’ choice.

Talk about a printer jam; It turns out there was a problem with the new $100 bills that were being printed by the US Treasury… a $120 million dollar problem. Originally scheduled to be issued in 2011, these new high-security C-Notes were announced with big fanfare. However, as the the first billion notes rolled off the presses, it was discovered that ?sporadic creasing of the paper? had caused a small sliver on some of the bills to be printed incorrectly. This ?glitch? caused a 2-year delay in the release of the new bills as they sorted the good from the bad, costing $120 million extra… at the US taxpayers’ expense, of course!

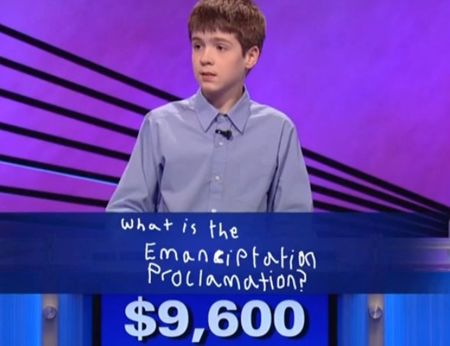

Alex Trebek said it was "badly misspelled."

It seems like a pretty innocent mistake, given the age and the circumstances. Nonetheless, Thomas Hurley III’s misspelled answer for Final Jeopardy! cost him the $3000 wager. The correct written response to the answer was ?What is the Emancipation Proclamation?? (Jeopardy! contestants must guess the correct question), but Hurley spelled it Emanciptation Proclamation [sic] and host Alex Trebek and the show judges deemed it incorrect. ABC producers responded to the decision by saying, "If Jeopardy! were to give credit for an incorrect response (however minor), the show would effectively penalize the other players.? Still, that doesn’t sit well with a lot of people who felt Trebek and company cheated a little boy out of his hard-earned cash.

In a situation similar to a drug addict being allowed unlimited access to crack cocaine, retired Flint Michigan autoworker Ronald Paige discovered that he was able to withdraw vast sums of money from Bank of America ATMs. For 14 days, Paige was able to withdraw – and subsequently gamble away – the bank’s money due to a ?glitch? in their ATMs at several casinos in the area. During his almost non-stop spree (he went 36 hours without sleep) he had withdrawn $1,543,100. Paige was ?completely apologetic.? Nonetheless, he was sentenced to 15 days in prison and ordered to repay the $1.5 million in installments from his $2000 monthly pension.

This is Dori Rhodes before her $18k mistake.

Talk about regrets… Huntington Beach resident Dori Rhodes donated items to a community yard sale on May 18, 2013, thinking she was getting rid of things she no longer used or needed. Well, it turns out that one of the items she gave them – a denim jacket that sold for $20 – had a couple of extra surprises in the pockets. She forgot that she used the old denim jacket, which hung in the back of her closet, as a de-facto safe to keep valuables and money. Not only was there a pair of $18,000 diamond earrings, but there was also a $1500 ring that her husband had given her. Of course, she is devastated by the error, and is hoping that the stranger who purchased the jacket returns the valuable items. So far, she’s had no luck.

It may seem like a small amount of money (@$2200 US), but it underscores a common problem in the banking industry. Inadvertent mistakes by people using online banking can lead to financial pain. In this particular case, a woman from South Wales attempted to move 100,000 Pounds from one Nationwide Bank account to another, and mistakenly typed in one wrong digit of her 8-digit account. When the money didn’t show up a few days later, she contacted the bank and was eventually able to recover 98,600 of it, but 1,400 was deemed irretrievable because it would ?push the other customer into their overdraft,? according to the Mail UK. The larger problem is exposed and discussed in a lengthy article, which estimates that millions of pounds are lost every year in similar mishaps. Bottom line: Be careful what you type when transferring your money.